The rise in scams targeting seniors is more than just alarming—it’s a call to action for everyone. Seniors often become the victims of fraud due to a lack of digital literacy, isolation, or cognitive decline. This makes them particularly vulnerable to a range of scams, from financial exploitation to identity theft. Understanding the common tactics that scammers use can be the first line of defense against these predatory practices. This article aims to shed light on the various ways scammers try to rip off seniors and offers actionable advice on how to protect against such scams. So, let’s delve into the world of scams to arm yourself with the knowledge needed to fight back.

Contents

The Psychology Behind Scams

Scammers often employ emotional manipulation to lure their victims into a false sense of security. They use tactics that evoke fear, urgency, or trust to make seniors act against their better judgment. For instance, a scammer might pose as a government official and claim that immediate action is required to avoid legal consequences. The sense of urgency leaves little time for the victim to think or consult with family, making them more likely to comply.

Cognitive biases also play a significant role in the success of scams. Scarcity, authority, and social proof are some of the psychological triggers that scammers exploit. A scammer might claim that an “exclusive” investment opportunity is available for a limited time, leveraging the scarcity bias to prompt quick action. Alternatively, they might impersonate someone in a position of authority, like a police officer or a bank manager, to make their scam seem more credible. Understanding these psychological tricks is the first step in guarding against scams. Now, let’s explore some of the more common scams that target seniors.

Financial Exploitation

Financial scams targeting seniors are both diverse and devastating. One common method is offering fake investment opportunities, such as Ponzi schemes or “too good to be true” investments. These scams promise high returns with little to no risk, enticing seniors to part with their hard-earned savings. Often, these schemes collapse, leaving the victims with significant financial loss.

Another form of financial exploitation involves fraudulent bank activities. Scammers send phishing emails that look like they’re from a legitimate bank, asking the recipient to update their account information. Alternatively, they might call, posing as bank representatives, claiming that there’s been suspicious activity on the account. In both cases, the goal is to acquire sensitive financial information, which can then be used to drain the victim’s accounts.

Identity Theft

Identity theft is a growing concern, especially for seniors who may not be as tech-savvy. One common scam involves Social Security fraud, where scammers call victims claiming that their Social Security number has been compromised. The scammer then asks for personal information to “verify” the victim’s identity, only to use that information for fraudulent activities later.

Medicare scams are another form of identity theft that specifically targets seniors. Scammers pose as Medicare representatives and ask for personal information, claiming it’s necessary for updating records or providing additional services. Once they have this information, they can make fraudulent medical claims or sell the data to other criminals. Being aware of these tactics can help seniors guard against identity theft and its damaging consequences.

Door-To-Door Scams

Door-to-door scams are particularly insidious because they take advantage of the victim’s trust in face-to-face interactions. One prevalent scam is the home repair con, where scammers pose as contractors offering to fix a supposed issue with the home. They may ask for payment upfront and then disappear without completing any work. Alternatively, they might do a shoddy job, leaving the homeowner with both a lighter wallet and unresolved issues.

Fake charity collections are another door-to-door scam that targets seniors. Scammers pose as volunteers collecting money for a charitable cause, often one that tugs at the heartstrings, like children’s hospitals or disaster relief. The scammer takes the money, and the charitable cause never sees a dime. Being cautious about who is allowed into one’s home and verifying the legitimacy of any service or charity can go a long way in preventing these scams.

Family And Friend Impersonation

Impersonation scams are emotionally manipulative and can be deeply distressing for the victim. The “grandparent scam” is a classic example, where the scammer calls a senior pretending to be a grandchild in distress, often claiming to be in jail or stranded abroad. They ask for money to be sent immediately, exploiting the senior’s concern for their loved ones.

Romance scams are another form of impersonation that targets lonely seniors. Scammers create fake profiles on dating websites or social media platforms and establish an emotional connection with the victim. After gaining their trust, they concoct a crisis that requires financial assistance, such as medical bills or travel expenses. Once the money is sent, the scammer disappears, leaving the victim emotionally and financially devastated.

Service And Product Scams

The marketplace is not free from scams targeting seniors, especially when it comes to health and legal services. Counterfeit prescription drugs are sold online, promising the same benefits as the real thing but at a fraction of the cost. Not only is the victim cheated financially, but they also risk their health by consuming potentially dangerous substances.

Similarly, fake anti-aging products and fraudulent legal services are sold with the promise of life-changing results. These scams prey on the fears and insecurities that many seniors face, such as declining health or the need for estate planning. Always verifying the legitimacy of any product or service, especially those purchased online, can help seniors protect themselves from these types of scams.

Email And Online Scams

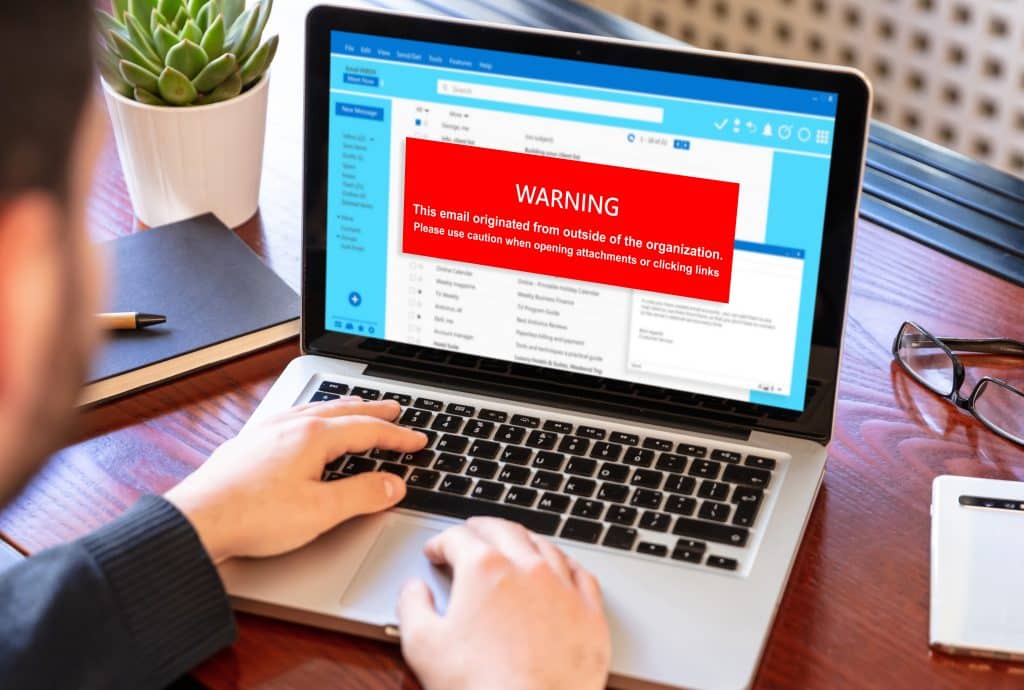

The digital world is a fertile ground for scams, and seniors are often the least prepared to navigate these murky waters. Lottery and sweepstakes scams are common, where an email claims that the recipient has won a large sum of money. To claim the prize, they’re asked to pay a “processing fee” or provide personal information, leading to financial loss or identity theft.

“You’ve been hacked” scams are another online threat. These emails claim that the victim’s computer has been hacked and demand a ransom, usually in cryptocurrency, to unlock the files. In reality, the computer is often not hacked at all, but the fear and urgency created by the message can lead seniors to comply. Being skeptical of unsolicited emails and verifying their legitimacy can help protect against these and other online scams.

Prevention And Protection

Preventing scams starts with securing personal information. Seniors should be cautious about sharing any sensitive data, whether it’s over the phone, in an email, or in person. Strong, unique passwords for online accounts and two-factor authentication can add an extra layer of security. Additionally, important documents like Social Security cards and passports should be stored in a safe place, away from prying eyes.

Education is another powerful tool in the fight against scams. Seniors should be encouraged to attend workshops or read articles about common scams and how to avoid them. Sharing information with friends and family can create a network of informed individuals who can look out for each other. Reporting scams to the authorities can also help prevent others from falling victim to the same tactics.

Empower Yourself Through Awareness!

Scams targeting seniors are an unfortunate reality, but knowledge is the most potent weapon in combating them. While this article has covered a range of scams, from financial exploitation to impersonation, the underlying message is clear: awareness and vigilance are key. By taking proactive steps to protect personal information and by staying educated about the latest scam tactics, seniors and their loved ones can build a strong defense against these predatory practices.